Bailed on GALT yesterday @1.67, ^62%. I'll take that, down 20% right now. Sometimes you time it right

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SVTP stock pick thread.

- Thread starter STAMPEDE3

- Start date

Bailed on GALT yesterday @1.67, ^62%. I'll take that, down 20% right now. Sometimes you time it right

Very nice! Good call on that. I bought DRYS on Monday lost 5% and tripped my stop loss - right after it hit my stop loss it went straight up again to 15% timing is everything!

Sent from my iPhone using the svtperformance.com mobile app

May buy back tomorrow. Ratings are still long and their trial drug is in phase 2 and sounding promising.

I love seeing stocks tank after I sell. I sold SGNL at 14.32 before the merger meeting, and it tanked after and remains below $12 as MGEN and I believe dilution coming. I went back in on OCUL today. I am also in CERU hoping for some big action tomorrow and next week.

It definitely supports your decision to sell when a stock drops.

I bought GALT again @ 1.55, looking at 10% already, waiting for volume to move it higher again. Love the ride!

I bought GALT again @ 1.55, looking at 10% already, waiting for volume to move it higher again. Love the ride!

QUESTION: Who is everyone using for online trading?

Have you ever switched?

Are there any fees involved in switching?

I use TDAmeritrade currently, but I see there are cheaper options. 9.99 commissions start to hurt after a few trades, especially if you can buy/sell for half that.

Have you ever switched?

Are there any fees involved in switching?

I use TDAmeritrade currently, but I see there are cheaper options. 9.99 commissions start to hurt after a few trades, especially if you can buy/sell for half that.

^^^ Download the app called "Robinhood." Free trading.

It definitely supports your decision to sell when a stock drops.

I bought GALT again @ 1.55, looking at 10% already, waiting for volume to move it higher again. Love the ride!

Sold JNUG with profit at 11.80 premarket yesterday, closed at 10.43 lol! Love it. I use Robinhood for free trades on a lot of stuff, but I'm transitioning towards Merrill Edge because I'm getting into options and like the ability on stocks to do stuff like trailing stop loss % and all or nothing orders. Just way more stuff you can do. And a lot of warrants you can't buy on Robinhood either. Plus Edge gives me access to the entire premarket and after hours unliked Robinhood Gold where I only get 30 minutes premarket and 2 hours after hours. Not to mention all the crashes/freezing in the morning with Robinhood and lack of any real research tools.

Oh I also bought DCTH earlier this week. Made a mistake and paid a little too much, averaged down big after it dipped that day, sold the next day for profit at 21 cents. Started almost immediately tanking and now it's 16 cents with no bottom in sight. Right now AUPH is my only weekend holding. Hoping to play the run up to data and get out before it comes. Maybe pick up some calls

I took a beating yesterday on DRYS. I had a lot of money in so I was not going to risk leaving it overnight. It tripped my stop loss and I lost. I do think it will spike today in the morning again, but probably die off in the afternoon.

Sent from my iPhone using the svtperformance.com mobile app

Sent from my iPhone using the svtperformance.com mobile app

Hey guys,

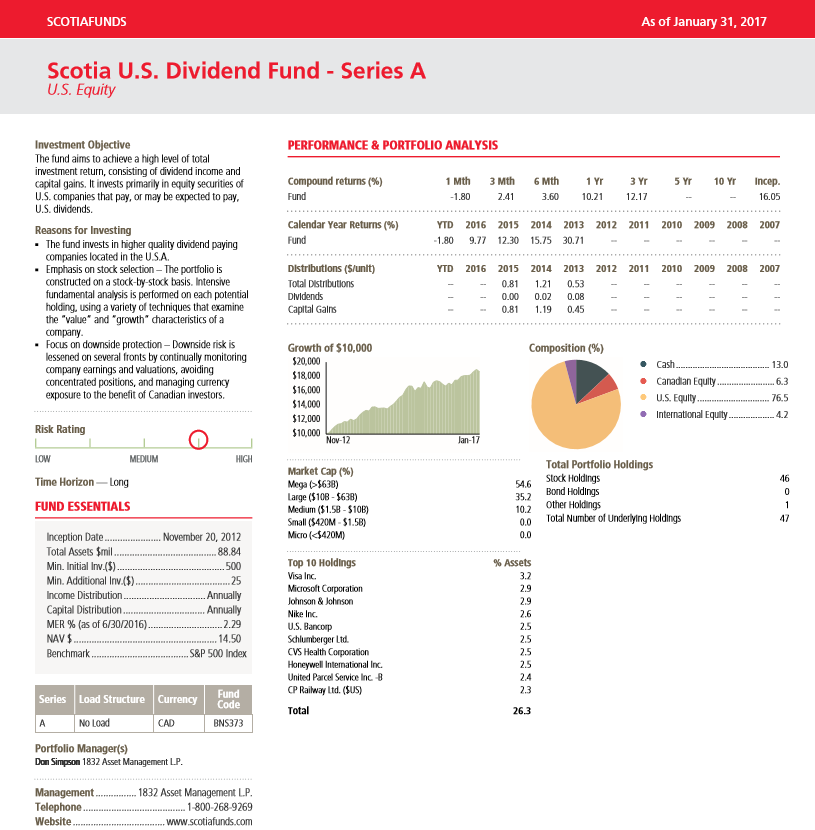

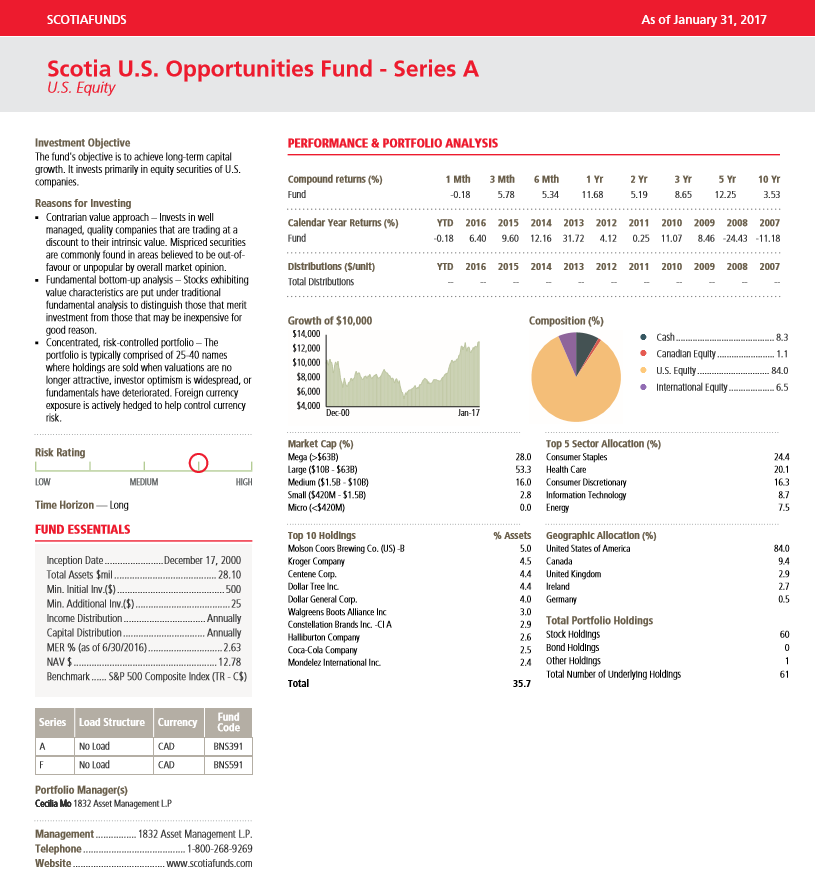

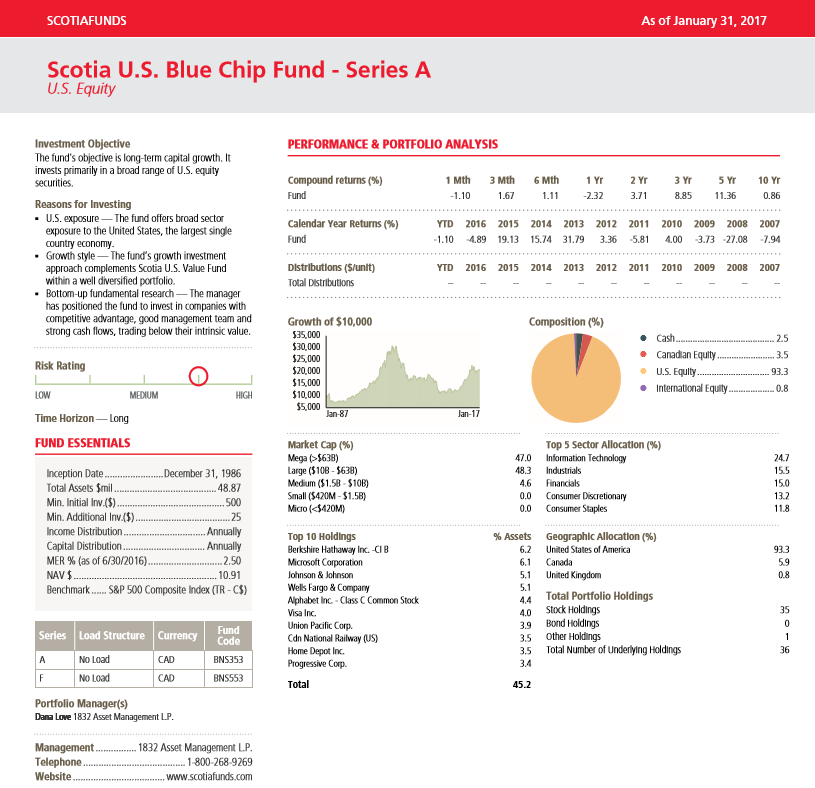

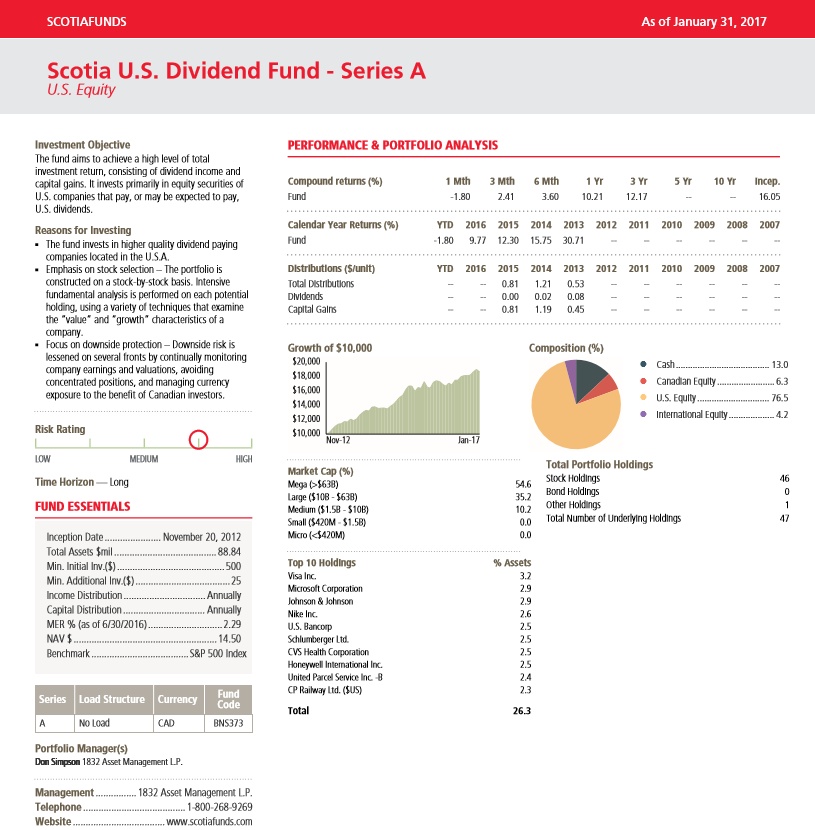

I know this isn't technically stocks, but I was hoping you guys could give me some feedback/advice on which mutual funds I should purchase.

I already have a lot of Canadian and Pacific Rim funds in my current portfolio, so I want to add in some US funds, especially with Trump now being in power, and with the great speech he delivered last night.

Which one of these three US funds looks the most promising to you for a long-term higher risk investment?

U.S. Dividend Fund - $15.14 a share

U.S. Opportunities Fund - $13.09 a share

U.S. Blue Chip Fund - $11.54 a share

Thanks guys!

I know this isn't technically stocks, but I was hoping you guys could give me some feedback/advice on which mutual funds I should purchase.

I already have a lot of Canadian and Pacific Rim funds in my current portfolio, so I want to add in some US funds, especially with Trump now being in power, and with the great speech he delivered last night.

Which one of these three US funds looks the most promising to you for a long-term higher risk investment?

U.S. Dividend Fund - $15.14 a share

U.S. Opportunities Fund - $13.09 a share

U.S. Blue Chip Fund - $11.54 a share

Thanks guys!

I took a beating yesterday on DRYS. I had a lot of money in so I was not going to risk leaving it overnight. It tripped my stop loss and I lost. I do think it will spike today in the morning again, but probably die off in the afternoon.

Sent from my iPhone using the svtperformance.com mobile app

DRYS spikes get weaker and weaker. The div announcement is a joke since they have no $ to pay it. Delistment is in their future. After I sell my AUPH I will complete transfer to Merrill Edge and trade options exclusively

It's funny because I was going to buy some March 17th AUPH calls at a $5 strike price for 20 cents. Would be sitting on a nice profit right now. The power of options is really hard to ignore

Hey guys,

I know this isn't technically stocks, but I was hoping you guys could give me some feedback/advice on which mutual funds I should purchase.

I already have a lot of Canadian and Pacific Rim funds in my current portfolio, so I want to add in some US funds, especially with Trump now being in power, and with the great speech he delivered last night.

Which one of these three US funds looks the most promising to you for a long-term higher risk investment?

U.S. Dividend Fund - $15.14 a share

Seems like a no brainer to go with this one

DRYS spikes get weaker and weaker. The div announcement is a joke since they have no $ to pay it. Delistment is in their future. After I sell my AUPH I will complete transfer to Merrill Edge and trade options exclusively

Yeah, I don't get burned often, but the hype of DRYS always makes me trade emotionally and set stop loss looser. I have gotten burned twice now. I think I have learned my lesson with them. They really don't follow any type of trend because it is all daytraders investing, driving up price, making profit, and dumping.

Today I did pretty good on SGY. They did a reverse split but I guess people thought the stock was up 250% just on news of them beating estimates and paying off 1.2billion in debt. Either way, I got it when it was heating up, made 15% and got out before they figured out the drastic jump was from the split. It tanked shortly after.

I can't trade for a few days until everything clears but next week I am looking to make some money. I can't believe how strong the market is. Not to get too political, but he def made the stock market great again. Lol

Sent from my iPhone using the svtperformance.com mobile app

Yeah, I don't get burned often, but the hype of DRYS always makes me trade emotionally and set stop loss looser. I have gotten burned twice now. I think I have learned my lesson with them. They really don't follow any type of trend because it is all daytraders investing, driving up price, making profit, and dumping.

Today I did pretty good on SGY. They did a reverse split but I guess people thought the stock was up 250% just on news of them beating estimates and paying off 1.2billion in debt. Either way, I got it when it was heating up, made 15% and got out before they figured out the drastic jump was from the split. It tanked shortly after.

I can't trade for a few days until everything clears but next week I am looking to make some money. I can't believe how strong the market is. Not to get too political, but he def made the stock market great again. Lol

Sent from my iPhone using the svtperformance.com mobile app

DRYS was a dirty pleasure of mine for a short while. Looking back at my trades I was in and out a total of 10 times. Got burned twice, ultimately ended up making some good coin. Look into options trading. Then plug some scenarios into http://www.optionsprofitcalculator.com/ and your mind will be blown. Take a particular look at going long on the FB 1/19/18 calls at a $180 strike price (very likely to hit) and you will be amazed. Make sure you change output type to dollar value on the lower drop down box below the table.

Edit: actually the 170s look better

DRYS was a dirty pleasure of mine for a short while. Looking back at my trades I was in and out a total of 10 times. Got burned twice, ultimately ended up making some good coin. Look into options trading. Then plug some scenarios into http://www.optionsprofitcalculator.com/ and your mind will be blown. Take a particular look at going long on the FB 1/19/18 calls at a $180 strike price (very likely to hit) and you will be amazed. Make sure you change output type to dollar value on the lower drop down box below the table.

Yeah I have always wanted to look into options, you have any links to info? I wouldn't mind learning a new skill.

Sent from my iPhone using the svtperformance.com mobile app

Yeah I have always wanted to look into options, you have any links to info? I wouldn't mind learning a new skill.

Sent from my iPhone using the svtperformance.com mobile app

I'm starting to learn myself and want to start simple. A few youtube videos are good to watch on the subject and you can also pick up some books like "Understanding Options" and "The Options Playbook"

I'm starting to learn myself and want to start simple. A few youtube videos are good to watch on the subject and you can also pick up some books like "Understanding Options" and "The Options Playbook"

Okay, thanks. I might check them out. I usually do pretty well keeping it simple, but I am always looking for ways to do better.

Sent from my iPhone using the svtperformance.com mobile app

Okay, thanks. I might check them out. I usually do pretty well keeping it simple, but I am always looking for ways to do better.

Sent from my iPhone using the svtperformance.com mobile app

Options can get pretty complicated, but I had an "aha" moment after seeing some of the profit possibilities with such low investment amounts that I just can't see myself buying stocks any more

Users who are viewing this thread

Total: 22 (members: 0, guests: 22)