Just curious, what makes his methods safe and not feasible for wealth?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Real-Estate Bubble Popping?

- Thread starter Weather Man

- Start date

Just curious, what makes his methods safe and not feasible for wealth?

He views debt as bad, regardless. No way that I'll be paying off my 30-year fixed mortgage a day early at 2.75%. Same with my auto loans. Under a certain threshold, I take a loan and throw cash into the markets.

Debt is healthy and can be used to build wealth much quicker than paying off loans early typically can.

He views debt as bad, regardless. No way that I'll be paying off my 30-year fixed mortgage a day early at 2.75%. Same with my auto loans. Under a certain threshold, I take a loan and throw cash into the markets.

Debt is healthy and can be used to build wealth much quicker than paying off loans early typically can.

100% agree.

As soon as rates climbed above 3, I cancelled all my excess payments and will just be paying the minimum.

He views debt as bad, regardless. No way that I'll be paying off my 30-year fixed mortgage a day early at 2.75%. Same with my auto loans. Under a certain threshold, I take a loan and throw cash into the markets.

Debt is healthy and can be used to build wealth much quicker than paying off loans early typically can.

Yup. Not paying off anything faster now since all my loans are near or at 3%.

I think Ramsey has a point for some who overspend past their means. But like you said debt can be a good thing when not abused.

He knows his stuff. He’s been in real estate for over 40 years and finance for 35.

So laugh all you want.

Literally every single point he used to explain why prices went up so much will go away in the next 12 months.

You would really have to be foolish to think there won’t be a significant price retraction. Wipe out all gains? No.

I think you will find a segment of people that have bought with the higher rates and higher price point struggling to justify their purchase in a couple years.

Stings less if you rotated out of one house and profited. Gave all your profit to the next guy though and now you just have an overpriced house.

I don’t care if you’re talking about real estate, stocks, or BTC. If you’re up 51-75% in just a year or two, you’re foolish to A. Not sell. B. Not expect a price retraction.

Sent from my iPhone using the svtperformance.com mobile app

Ramsey is speaking to the 75%.Yup. Not paying off anything faster now since all my loans are near or at 3%.

I think Ramsey has a point for some who overspend past their means. But like you said debt can be a good thing when not abused.

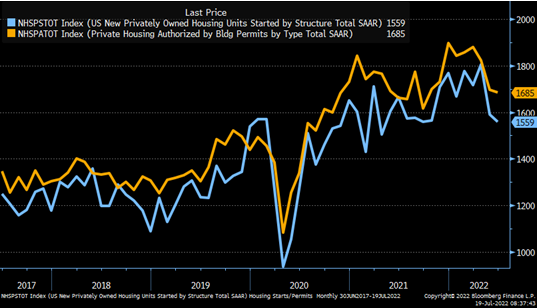

* Single-family housing as an asset class has strongly outperformed equity, credit, and fixed income indices the past two years, with home prices gaining 40%. More recently, the steep rise in mortgage rates has significantly challenged affordability, and there are early signs that excess demand is cooling.

* While the recent outperformance of housing equity is highly likely to subside as HPA slows, outstanding mortgage debt remains attractive. Credit assets should perform even if home prices pull back.

* Most homeowners are locked into fixed-rate mortgages well below the prevailing rate, and would face higher, variable shelter costs by purchasing a new home or renting. Homeowners also have significant embedded equity and wealth in their homes, as borrowers have largely refinanced to lock in lower rates rather than tap equity. This is the opposite backdrop to 2008’s strategic defaults and, from a credit perspective, should encourage and allow borrowers to remain current and stay in their homes.

* The “rate lock-in” effect should also help constrain existing supply, which already stands at record lows. More structurally, builders’ reluctance to significantly invest in new construction following the 2008 housing market collapse has created an undersupply of single-family homes estimated in the millions.

You only get hurt if you jump off in the middle of the roller coaster.Literally every single point he used to explain why prices went up so much will go away in the next 12 months.

You would really have to be foolish to think there won’t be a significant price retraction. Wipe out all gains? No.

I think you will find a segment of people that have bought with the higher rates and higher price point struggling to justify their purchase in a couple years.

Stings less if you rotated out of one house and profited. Gave all your profit to the next guy though and now you just have an overpriced house.

I don’t care if you’re talking about real estate, stocks, or BTC. If you’re up 51-75% in just a year or two, you’re foolish to A. Not sell. B. Not expect a price retraction.

Sent from my iPhone using the svtperformance.com mobile app

You only get hurt if you jump off in the middle of the roller coaster.

Meh. This sounds like what the TSP guru with 80k followers suggest. Had everyone sit an funds that follow the Dow and S&P and majority are down 20% right now.

That’s fine and sure, following the likely price retrace we’ll have, home/stock prices will likely come back to where they are now eventually.

For those that didn’t buy during this surge, they have equity, for now.

For those that just bought in the last 6-12 months, ouch. Hopefully they sold another property for a huge gain to fund their purchase.

Also of note, the price increases have not occurred at the same time or rate nationally.

I sold my SoCal home in 12/20 after a 20% bump. Prices have hardly changed at all since then. Still sold it for less than I paid in 2005.

The price jump in W TX and S TX had barely started then. I was under contract to sell at 269k in 5/21. Deal was a mess and I cancelled it. Sold at 365k 12/21. This particular unit was valued around 315k in 2013. I paid 229k in late 19’. Not a distressed sale. 60% profit in 2 yrs. I wouldn’t be surprised at all to see that particular unit drop down to the low 3s again.

My primary residence in TX is up about 50% as well.

The discrepancy was/is strange. I suppose this is the migration Dave mentioned. Shouldn’t really cross directly into vacation properties though.

Sent from my iPhone using the svtperformance.com mobile app

Yep. That's actually how Warren Buffet made some big money back in the day. He bought a vacation home in 1971 in Laguna Beach for 150k. He was already worth many millions then and could have paid cash but put down 30k and borrowed the rest because he thought he could probably do better with the money than have it be an all equity purchase of the house. Buffett ended up buying shares of Berkshire Hathaway with the money he could have used to purchase the home. As a result, he ended up turning the $110,000 or $120,000 that he'd have paid in cash for the home into a whopping $750 million because Berkshire shares have gone up so much in value.He views debt as bad, regardless. No way that I'll be paying off my 30-year fixed mortgage a day early at 2.75%. Same with my auto loans. Under a certain threshold, I take a loan and throw cash into the markets.

Debt is healthy and can be used to build wealth much quicker than paying off loans early typically can.

The above quote was from this article, and I know it to be true because I've heard him state the same thing a few other times.

Warren Buffett's Mortgage Advice Beats Dave Ramsey's Any Day of the Week. Here's Why.

Billionaire Warren Buffett and personal finance guru Dave Ramsey have very different philosophies on mortgage debt. Here's why Buffett's view is better.

Just curious, what makes his methods safe and not feasible for wealth?

Dave Ramsey went bankrupt trying to flip houses in the 80s…

His idea that paying off ALL debt as fast as possible and using mutual funds as your key investment grower is just… INSANE for anyone trying to grow their wealth.

With that said, following his advice will make sure your comfortably, but just above the poverty line.

Another interesting tidbit about Ramsey… he fires people that have premarital sex.

Dave Ramsey is a loon.

trump filed bankruptcy too in the past. I dont think any less of him for it. I was raised its more important how you get back up rather than how you fall.

I paid off all my debt as soon as possible long before I ever heard of dave. I was raised you only get what you can work to afford.

I saved over 30k in interest on my house paying it off undrr half of the term and since it was paid off i saved 4k a year in home owners insurance I didnt need.

I put that money in a savings for my emergency home fund. Every few years it builds up enough that I buy another property with it. I then rent lease or sell that property later down the line if a deal comes along.

Im not rich nor am I poor. Id say im average middle class. I live within my means.

I dont do anything with the stock market. I have way too many friends that have lost millions doing so.

Id think Dave would approve.

I paid off all my debt as soon as possible long before I ever heard of dave. I was raised you only get what you can work to afford.

I saved over 30k in interest on my house paying it off undrr half of the term and since it was paid off i saved 4k a year in home owners insurance I didnt need.

I put that money in a savings for my emergency home fund. Every few years it builds up enough that I buy another property with it. I then rent lease or sell that property later down the line if a deal comes along.

Im not rich nor am I poor. Id say im average middle class. I live within my means.

I dont do anything with the stock market. I have way too many friends that have lost millions doing so.

Id think Dave would approve.

As a few have said, the carrying cost of low interest debt means it’s more valuable to keep your money in your pocket.Just curious, what makes his methods safe and not feasible for wealth?

For example, you’re paying 3% on your mortgage. By keeping this loan, you keep cash that can be invested at say 8%. That’s +5% to you, roughly

Your friends took some ballsy gambles. You don’t need to get fancy for 7-8% to pay off huge in the long run.trump filed bankruptcy too in the past. I dont think any less of him for it. I was raised its more important how you get back up rather than how you fall.

I paid off all my debt as soon as possible long before I ever heard of dave. I was raised you only get what you can work to afford.

I saved over 30k in interest on my house paying it off undrr half of the term and since it was paid off i saved 4k a year in home owners insurance I didnt need.

I put that money in a savings for my emergency home fund. Every few years it builds up enough that I buy another property with it. I then rent lease or sell that property later down the line if a deal comes along.

Im not rich nor am I poor. Id say im average middle class. I live within my means.

I dont do anything with the stock market. I have way too many friends that have lost millions doing so.

Id think Dave would approve.

US stocks historical average is around 10%. Doubles your money every 7 years

We moved to the Las Vegas metro in 2018 but lived in Madison prior to moving here. We lived in Cottage Grove (I think that is where they built the Amazon distribution center?). When we left Cottage Grove it was a small, sleepy little place with the only houses being built over behind Glacial Drumlin MS and they were bigger homes that were expensive. There was absolutely no building going on when we lived there. My wife and daughter went back to visit in May of this year and said the town is blowing up. Upscale apartments and new single family homes. Place is growing like CRAZY.Same here. I saw a recent story that said the county I'm in (Dane) underbuilt by 11,000 housing units from 2006-2017. The county is also growing faster than pretty much anywhere in the Midwest.

I find it nuts that a decent 800 sq ft apartment is going for a minimum of $2k right now and could easily be $2700 for better locations.

We just paid far more for a house than I ever thought I would but we relocated into a community that is in high demand and an Amazon distribution facility has been approved there and will bring 1500 jobs to a village with a population of 7300. I'm not the slightest bit worried that the market will crash in my area.

I never understood the attraction to Madison city. My buddy lives in Tenny Park (has rented there for at least 8-10 years) and the prices of real estate 10 years ago was insane. Old homes, no central AC, no attached garages. I never understood the attraction. I guess the park is nice, and a lot of young people with good jobs like city living there. We had some great parties in his neighborhood because it was a younger crowd. But for me, I wouldn't consider city living like that if we still lived in WI.For reference and for shits and grins, when I rented a one bedroom out there on the SW side (Waterford Circle), I paid $785/month rent. This was in ~2014. I always figured part of the higher rents were due to students and Epic employees.

A shanty two houses down from me just went up for sale. 15xx sq ft ranch built in the late 60s. Partially updated. Good starter house IMO. Asking $329,900. That's ridiculous for that house around here. And they've got an offer! Fingers crossed a burner who likes to drink moves in. I like fun neighbors. haha

Rewinding for the sake of local comparison, four years ago I paid $335k for 2500sq ft, completely updated (inside and out including roof, siding, windows, gutters, garage doors...) two stories, 4 bdrm, 2.5 baths (upstairs are both dual vanity) and 3.75 car climate controlled garage. Really puts things into perspective when you've got places right around you going for insane prices. Also makes me happy we bought when we did. lol

As far as the topic discussion goes, we bought our house in Henderson/Vegas two years ago for $525k. It is valued at $840K currently. Even if it lost 25% of its value due to a "crash" it would still be worth $640k, which is insane considering we purchased it two years ago. The market has to cool. That type of increase in value cannot be sustained.

I was only living there because I was promoted (UPS) and had to move to follow it. 4.5 years later I was outta there. ha Nowadays I try to avoid that city much like i try to avoid Chicago traffic. lolI never understood the attraction to Madison city. My buddy lives in Tenny Park (has rented there for at least 8-10 years) and the prices of real estate 10 years ago was insane. Old homes, no central AC, no attached garages. I never understood the attraction. I guess the park is nice, and a lot of young people with good jobs like city living there. We had some great parties in his neighborhood because it was a younger crowd. But for me, I wouldn't consider city living like that if we still lived in WI.

If interest rates get up to 7-8%, the housing market is going to see more than a 25% correction. In the 70-80s, when interest rates were high, the average home was $60-70k. Now the average home is around $400k. At 3% interest, you could buy a $700k house on a $2900 payment, which is the same payment at a $400k house at 8%. That is a lot more than a 25% correction. Then you have to consider how much home the banks will qualify people to buy. Allowable debt to income on the high end is around 40%. At 80k median income, that allows about $2700 in house payment if their are no other debts. Now the average car payment is $700 a month. One car payment knocks the house payment down to $2k a month. I think $275k is where the average home price is going to drop in order for people just to be able to afford to buy.As far as the topic discussion goes, we bought our house in Henderson/Vegas two years ago for $525k. It is valued at $840K currently. Even if it lost 25% of its value due to a "crash" it would still be worth $640k, which is insane considering we purchased it two years ago. The market has to cool. That type of increase in value cannot be sustained.

I dunno, even if I owned my house in full, I would still have homeowners insurance if I lived in a state prone to hurricanes.

4k+ deducible vs rebuilding my house out of my pocket seems like a worthy "insurance".

Especially with how powerful some of the recent year storms are becoming.

Different topic though

4k+ deducible vs rebuilding my house out of my pocket seems like a worthy "insurance".

Especially with how powerful some of the recent year storms are becoming.

Different topic though

You might be right, I don't know. And it seems realistic IMO. To go from $400k to $275k that is a decrease of about 42%. If you apply that to my situation, the value of my home would be about $575k. If you told me I would buy a house and in 2 years the value would increase by $50k I'd be happy; that's about 5% growth per year. Seems "normal" to me. For a home's value to be artificially pumped up by over $300k in 2 years is unrealistic. Easy come, easy go!If interest rates get up to 7-8%, the housing market is going to see more than a 25% correction. In the 70-80s, when interest rates were high, the average home was $60-70k. Now the average home is around $400k. At 3% interest, you could buy a $700k house on a $2900 payment, which is the same payment at a $400k house at 8%. That is a lot more than a 25% correction. Then you have to consider how much home the banks will qualify people to buy. Allowable debt to income on the high end is around 40%. At 80k median income, that allows about $2700 in house payment if their are no other debts. Now the average car payment is $700 a month. One car payment knocks the house payment down to $2k a month. I think $275k is where the average home price is going to drop in order for people just to be able to afford to buy.

Your scenario also seems more likely given the fact that wages/compensation are becoming stagnant again after increasing rapidly over the past year or so. With workers' pay not increasing dramatically, they have less spending power.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)