You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BITCOIN

- Thread starter Weather Man

- Start date

Coinbase Pro or Coinbase? I don't think Binance offers staking with ADA. It is time to start staking a few cryptos.ADA and Sushi on CoinbaseHave ADA on Binance but picked up more on CB

I know pro has it of today, was too scared to login back at Coinbase as i just transferred everything and figured the universe would explodeCoinbase Pro or Coinbase? I don't think Binance offers staking with ADA. It is time to start staking a few cryptos.

You can convert various cryptos to XRP on shapeshift and send it to your Coinbase or Binance XRP wallets. Or buy cryptos on Changelly. While trading has been suspended you can still deposit and withdraw.I'd like to but can't on kraken or webull and I dont feel like opening another exchange.

I have personally only used Shapeshift and this is how I acquired XRP in 2017/2018. I am not sure how Changelly works.

ShapeShift | Home

A Detailed Comparison: Changelly Vs. ShapeShift

We'll have to see how the SEC lawsuit resolves. Just wish the government would mind it's own business. They are way too cocky and power hungry and **** up anything they touch.

SEC tells Judge that XRP is not like Bitcoin or Ether; questions ‘utility’ of XRP

US Judge Denies Request to Add XRP Holders as Intervenors in SEC's Lawsuit Against Ripple – Altcoins Bitcoin News

I just hodl on Coinbase. I prefer to trade on Binance because the fees are lower. Even Coinbase Pro has higher fees. The interface is also not as great. I find it easier to navigate Binance's trading platform. Though even that takes some getting used to.I know pro has it of today, was too scared to login back at Coinbase as i just transferred everything and figured the universe would explode

On an unrelated note, it is surprising how bad some of the gold / silver price charts are online. Cryptos have various platforms where is is easy to see price history on charts. The gold / silver price charts are small and look unprofessional.

TradingView supports gold / silver price charts and is great. Just would have thought there would be more ways to view price history.

Live stock, index, futures, Forex and Bitcoin charts on TradingView

On this chart the price is in kg. How do you get oz pricing history?

EDIT: I see now the kg price is on the left and oz price on the right. It would help if they had a heading on the right that said USD/oz.

Gold Price Chart

Here is an example of a poor chart platform imo.

Gold Price Today | Price of Gold Per Ounce | 24 Hour Spot Chart | KITCO

TradingView supports gold / silver price charts and is great. Just would have thought there would be more ways to view price history.

Live stock, index, futures, Forex and Bitcoin charts on TradingView

On this chart the price is in kg. How do you get oz pricing history?

EDIT: I see now the kg price is on the left and oz price on the right. It would help if they had a heading on the right that said USD/oz.

Gold Price Chart

Here is an example of a poor chart platform imo.

Gold Price Today | Price of Gold Per Ounce | 24 Hour Spot Chart | KITCO

I have been lucky enough to have a day trading buddy helping me learn to read some of this stuff, have kind of fell in love with Webull(charts much better than RH)...so i thought Coinbase pro and the lesser fees would be my answer to crypto(I’ve had Coinbase for probably a decade now, but 2.99 a transaction is stupid with my small account)...well, i think it sucks worse than regular Coinbase lol...but it’s only been a day, maybe I’ll change my mind.I just hodl on Coinbase. I prefer to trade on Binance because the fees are lower. Even Coinbase Pro has higher fees. The interface is also not as great. I find it easier to navigate Binance's trading platform. Though even that takes some getting used to.

I was excited about the ADA today, so maybe it’ll workout.

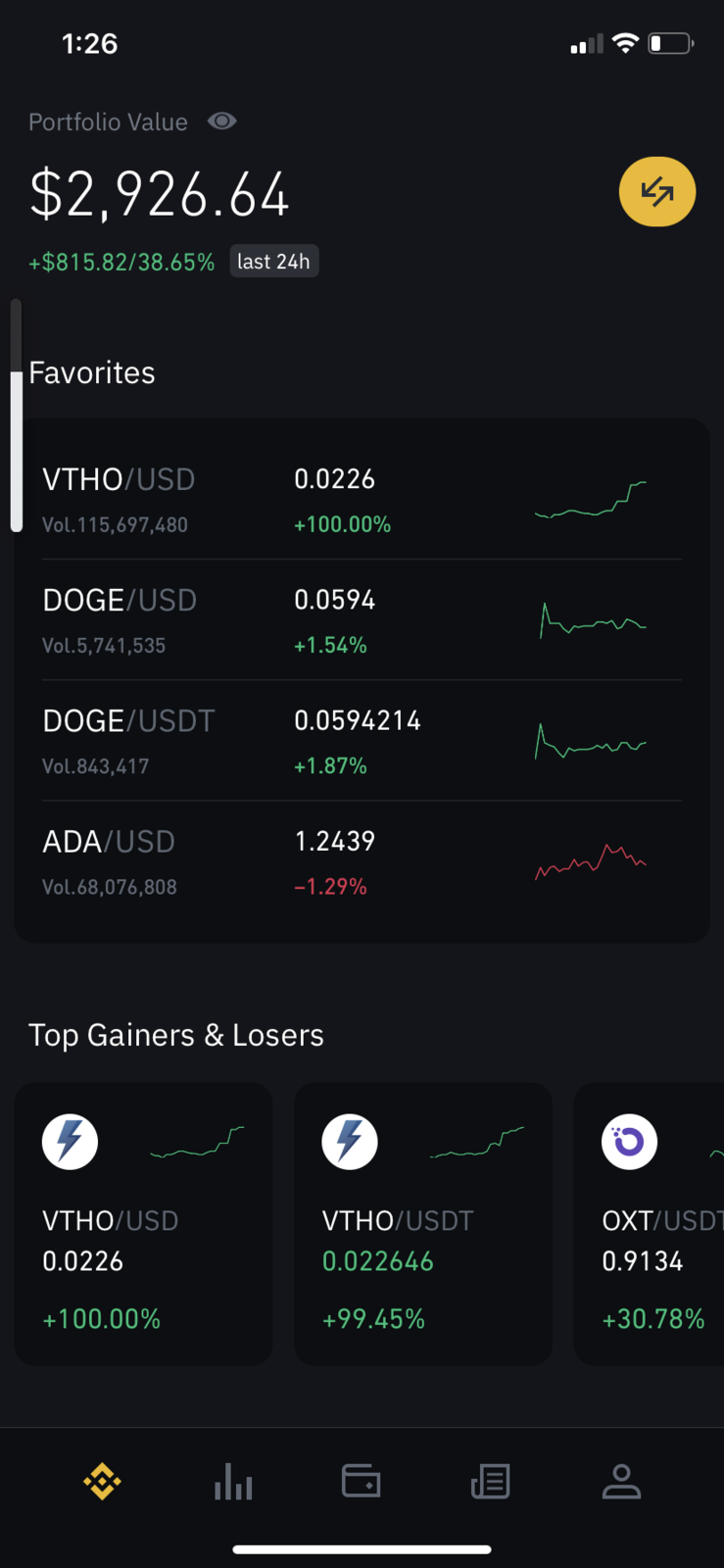

VTHO is on Fire!

Last edited:

What does that mean?It is time to start staking a few cryptos.

good interview

Is anyone using any apps to buy coins just hitting markets? Stuff that is a way bigger gamble? I’d like to start gambling with a few hundred dollars on more volatile stuff not listed on Binance.US.

Sent from my iPhone using svtperformance.com

Sent from my iPhone using svtperformance.com

Short answer:What does that mean?

Staking means you hold your crypto long term in a special wallet and are rewarded for this via interest payouts in the crypto of your choice. For example you could stake Ethereum and the interest could be paid out in Bitcoin. Or in Ethereum if you choose that route.

Long Answer:

Not an expert but this is how I understand it.

Bitcoin, Ethereum and a few others are secured via "Proof of Work" or POW. That means the transactions are solved by computing devices like GPUs and ASIC devices, also called "workers". Miners are basically people or companies that have a lot of "workers" hashing away on Bitcoin, Ethereum, Litecoin etc. They have to put work in to solve transactions.

A tremendous amount of hashing power is available and used and is increasing as time goes on. The transactions are all encrypted via various algorithms hence why they are called cryptocurrencies. Bitcoin has the most hashing power followed by I believe Ethereum.

Bitcoin = SHA-256

Ethereum = Ethash

Mining algorithms (Proof of Work): SHA-256, Scrypt, CryptoNight, Ethash and X11

A very important part is that the hashing power is decentralized which means there are many people and companies (miners) operating equipment on the network. If all the hashing power was centralized a 51% attack could occur. Below is a link explaining how that works. But basically things like double spending could occur where the accounting is not honest - for example you send 10 BTC to a friend and still get to keep the 10 BTC in your wallet. Or recent transactions could be erased from the blockchain as happened with Verge XVG recently.

What Is a 51% Attack?.

Verge (XVG) 51% Attack: Hundreds Of Thousands Of Blocks Affected

The problem with POW is it uses a lot of electricity. So another process was developed called "Proof of Stake" or POS. In this system the network is secured via many stakeholders holding a cryptocurrency in a special wallet that's connected to a validator. The validator is a computing device with adequate processing power. For example a quad core with 16 GB RAM. Validators are incentivized / rewarded to hold / stake their cryptos via interest payouts in the cryptocurrency over time. Bad validators / actors are penalized via slashing of funds. A POS system also needs to be decentralized like a POW system otherwise a 51% attack could also occur.

A validator needs to be online 24/7 and will be penalized if it goes offline.

Ethereum 1.0 is a POW cryptocurrency. Ethereum 2.0 will be a POS cryptocurrency. (lol) Cardano has been designed to be a POS cryptocurrency from the get go.

32 ETH is required to be an Ethereum validator.

Best Ethereum Validator Explanation: How to Become a Validator.

However exchanges like Coinbase (and others) will allow individuals with less than 32 ETH to stake their ETH on a pool with others. Stakeholders will receive interest payouts in ETH. Same goes for Cardano and a few others. The risk of slashed funds due to a bad validator is taken away because Coinbase would be taking on that burden.

Staking will promote people to save their investments and grow their wealth - the opposite of what is happening in the FIAT world where interest rates for savings accounts are negligible.

POS also uses a lot less power than a POW system. Experts are divided on whether POS offers more or less security compared with POW.

Thanks for that.Short answer:

Staking means you hold your crypto long term in a special wallet and are rewarded for this via interest payouts in the crypto of your choice. For example you could stake Ethereum and the interest could be paid out in Bitcoin. Or in Ethereum if you choose that route.

Long Answer:

Not an expert but this is how I understand it.

Bitcoin, Ethereum and a few others are secured via "Proof of Work" or POW. That means the transactions are solved by computing devices like GPUs and ASIC devices, also called "workers". Miners are basically people or companies that have a lot of "workers" hashing away on Bitcoin, Ethereum, Litecoin etc. They have to put work in to solve transactions.

A tremendous amount of hashing power is available and used and is increasing as time goes on. The transactions are all encrypted via various algorithms hence why they are called cryptocurrencies. Bitcoin has the most hashing power followed by I believe Ethereum.

Bitcoin = SHA-256

Ethereum = Ethash

Mining algorithms (Proof of Work): SHA-256, Scrypt, CryptoNight, Ethash and X11

A very important part is that the hashing power is decentralized which means there are many people and companies (miners) operating equipment on the network. If all the hashing power was centralized a 51% attack could occur. Below is a link explaining how that works. But basically things like double spending could occur where the accounting is not honest - for example you send 10 BTC to a friend and still get to keep the 10 BTC in your wallet. Or recent transactions could be erased from the blockchain as happened with Verge XVG recently.

What Is a 51% Attack?.

Verge (XVG) 51% Attack: Hundreds Of Thousands Of Blocks Affected

The problem with POW is it uses a lot of electricity. So another process was developed called "Proof of Stake" or POS. In this system the network is secured via many stakeholders holding a cryptocurrency in a special wallet that's connected to a validator. The validator is a computing device with adequate processing power. For example a quad core with 16 GB RAM. Validators are incentivized / rewarded to hold / stake their cryptos via interest payouts in the cryptocurrency over time. Bad validators / actors are penalized via slashing of funds. A POS system also needs to be decentralized like a POW system otherwise a 51% attack could also occur.

A validator needs to be online 24/7 and will be penalized if it goes offline.

Ethereum 1.0 is a POW cryptocurrency. Ethereum 2.0 will be a POS cryptocurrency. (lol) Cardano has been designed to be a POS cryptocurrency from the get go.

32 ETH is required to be an Ethereum validator.

Best Ethereum Validator Explanation: How to Become a Validator.

However exchanges like Coinbase (and others) will allow individuals with less than 32 ETH to stake their ETH on a pool with others. Stakeholders will receive interest payouts in ETH. Same goes for Cardano and a few others. The risk of slashed funds due to a bad validator is taken away because Coinbase would be taking on that burden.

Staking will promote people to save their investments and grow their wealth - the opposite of what is happening in the FIAT world where interest rates for savings accounts are negligible.

POS also uses a lot less power than a POW system. Experts are divided on whether POS offers more or less security compared with POW.

shame be upon you and your family forever if you sold your Bitcoin already

How big do you think the jump will be and how much should we buy?shame be upon you and your family forever if you sold your Bitcoin already

Watching stuff like this unfold is very entertaining.

How big do you think the jump will be and how much should we buy?

Watching stuff like this unfold is very entertaining.

Idk....I'm seeing estimates of $75k-$80k by the end of April, with a run up over $100k-$140k late Summer/Early Fall....with some calling for $200k+ by end of the year.

I used all the Stimulus I got from Biden and bought more at $53k.

I'm in a different head space than most here....I dont ever plan to sell my Bitcoin.

Last edited:

Same, still investing 25.00 a week into Bitcoin and 25.00 a week into Ethereum. Just comes out of my account so I don't even deal with it. I go with spurts of excitement where I check it and then days without. I assume that will go weeks or months maybe years.Idk....I'm seeing estimates of $75k-$80k by the end of April, with a run up over $100k-$140k late Summer/Early Fall....with some calling for $200k+ by end of the year.

I used all the Stimulus I got from Biden and bought more at $53k.

I'm in a different head space than most here....I dont ever plan to sell my Bitcoin.

Users who are viewing this thread

Total: 10 (members: 0, guests: 10)