Billionaire Charlie Munger calls crypto combination of fraud and delusion

BRK.B +1.14%Nov. 15, 2022 9:58 AM ET22 Comments98-year old billionaire Charlie Munger, a long time critic of crypto, called digital currencies a combination of delusion and fraud in the wake of the blowup of exchange FTX.

“You are seeing a lot of delusion," Munger, vice chairman of Berkshire Hathaway (NYSE:BRK.B), said in a CNBC interview. "Partly fraud and partly delusion. That’s a bad combination."

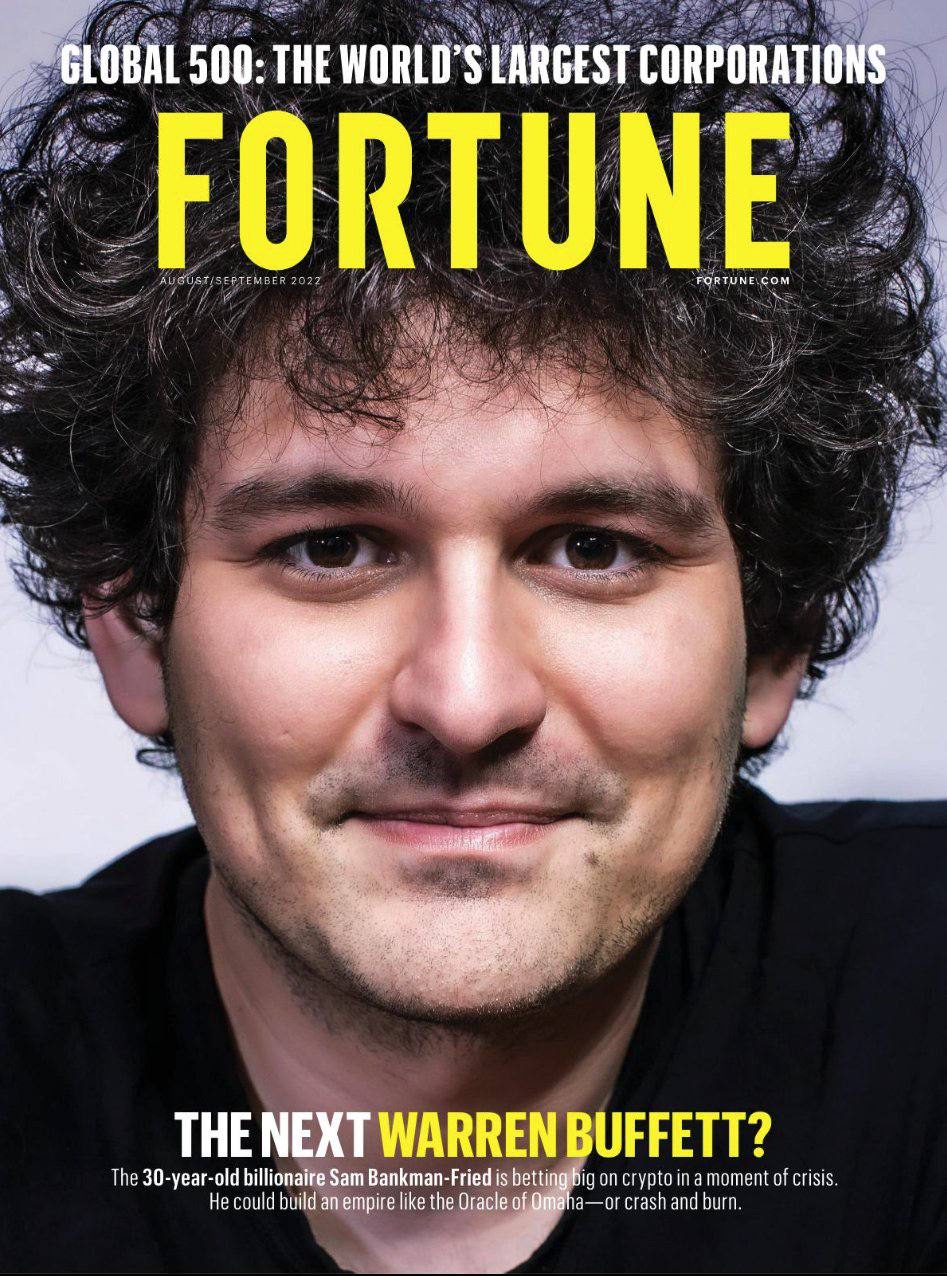

Bahamas-headquartered FTX filed for Chapter 11 bankruptcy on November 11 after traders rushed to withdraw billions of dollars from the platform in the wake of its multi-billion dollar shortfall.

“This is a very, very bad thing," Munger said. "The country did not need a currency that was good for kidnappers. There are people who think they’ve got to be on every deal that’s hot. I think that’s totally crazy. They don’t care whether it’s child prostitution or bitcoin.”

The once multibillion dollar exchange is under investigation by the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, and the Justice Department.

“Good ideas, carried to wretched excess, become bad ideas,” Munger told CNBC. “Nobody’s gonna say I got some s*** that I want to sell you. They say – it’s blockchain!”