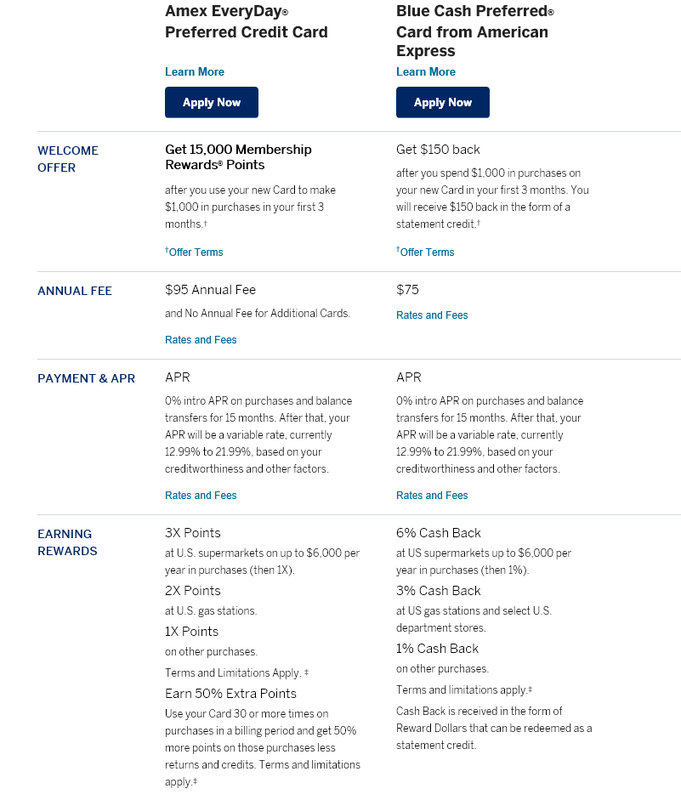

What type of credit card rewards do you guys tend to lean towards? What are the benefits of one over the other? I've never really given any thought to either until recently. But then I purchased a fairly expensive item using points and my eyes were open. I know that it's going to vary from card to card so as an example, I've had an Amex Every Day credit card for a while now and I'm looking to either upgrade to the Amex Everyday Preferred or switch to the Blue Cash (then eventually the Blue Cash Preferred when eligible). To be clear, I don't carry a balance from month to month so APR is somewhat irrelevant. I just use it for all of my purchases for the month, review my statement, and pay it off.

Is one better than the other? Or are we looking at more of a "6 in one, half-dozen in the other" situation?

Is one better than the other? Or are we looking at more of a "6 in one, half-dozen in the other" situation?