It's still pretty low, I might have to jump in. Are you thinking it will get to the teens or higher?Go BOIL go

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SVTP stock pick thread.

- Thread starter STAMPEDE3

- Start date

It's still pretty low, I might have to jump in. Are you thinking it will get to the teens or higher?

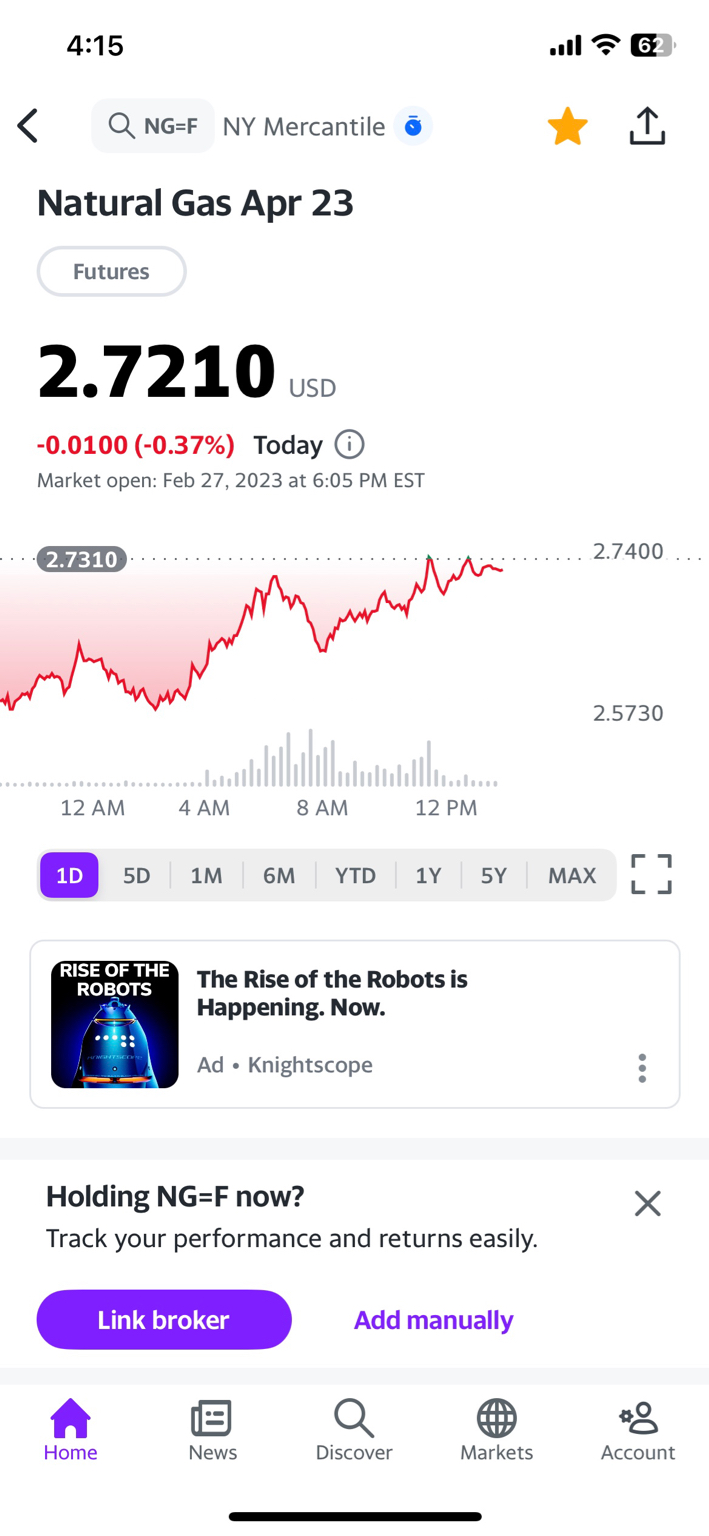

I don’t think so. I would like to see gas in the upper 2s and I’m dipping out.

Sent from my iPhone using the svtperformance.com mobile app

i don't really ever have a price target, when it starts to lose steam on the daily/weekly time frame, i will bow out again.It's still pretty low, I might have to jump in. Are you thinking it will get to the teens or higher?

keep in mind /NG can technically go negative i'm pretty sure

The thing about BOIL is you have the whole world geared up to "save Europe" by producing and shipping as much natural gas as possible. It's not market driven right now. That said, it's at the low-ish end and presumably will go higher at some point. I'm in for 2k shares at $5.12 at the moment.

I'm on the ledge about buying some. I think I'm going to wait until Monday afternoon to see how the weekend plays out.The thing about BOIL is you have the whole world geared up to "save Europe" by producing and shipping as much natural gas as possible. It's not market driven right now. That said, it's at the low-ish end and presumably will go higher at some point. I'm in for 2k shares at $5.12 at the moment.

I was in big on TECK but I had to unload some this morning after they made the announcement about raising interest again. shit just tanked by mid morning

I think we’ll see a continued creep up next week.

Prob see some freeze offs (lines shut down).

Big draw due to this late cold snap.

2nd biggest exporter in the nation just came back on line.

You generally see a bump going into spring as gas is needed for power generation in the summer. But most vendors tanks should be topped. Hard to say on that metric.

At least one producer has already reduced production due to low prices.

Sent from my iPhone using svtperformance.com

Prob see some freeze offs (lines shut down).

Big draw due to this late cold snap.

2nd biggest exporter in the nation just came back on line.

You generally see a bump going into spring as gas is needed for power generation in the summer. But most vendors tanks should be topped. Hard to say on that metric.

At least one producer has already reduced production due to low prices.

Sent from my iPhone using svtperformance.com

Main reason I got in BOIL was it finally crept above the EMA I use on the 1D chart, but more importantly...look how hard KOLD broke it's trend in the 4hr and daily

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Unsure if this is good or bad for BOIL. But it's call volume has been up end of last week. Saw some 5 and 5.5 activity.

The politicians did much better until this guy started reporting on them.

Sent from my iPhone using Tapatalk

The politicians did much better until this guy started reporting on them.

Sent from my iPhone using Tapatalk

Late to the game at 5 and 5.5. Closed at $6.00 Friday.

I’ve seen some articles about that LNG company. It has a strong dividend and it looks like they bought right before the dividend Ex date. Not an unusual strategy.

Heaviest option now is 6.50 @March3

Puts are less than a 1/4 of calls for that exp.

Sent from my iPhone using svtperformance.com

I’ve seen some articles about that LNG company. It has a strong dividend and it looks like they bought right before the dividend Ex date. Not an unusual strategy.

Heaviest option now is 6.50 @March3

Puts are less than a 1/4 of calls for that exp.

Sent from my iPhone using svtperformance.com

Last edited:

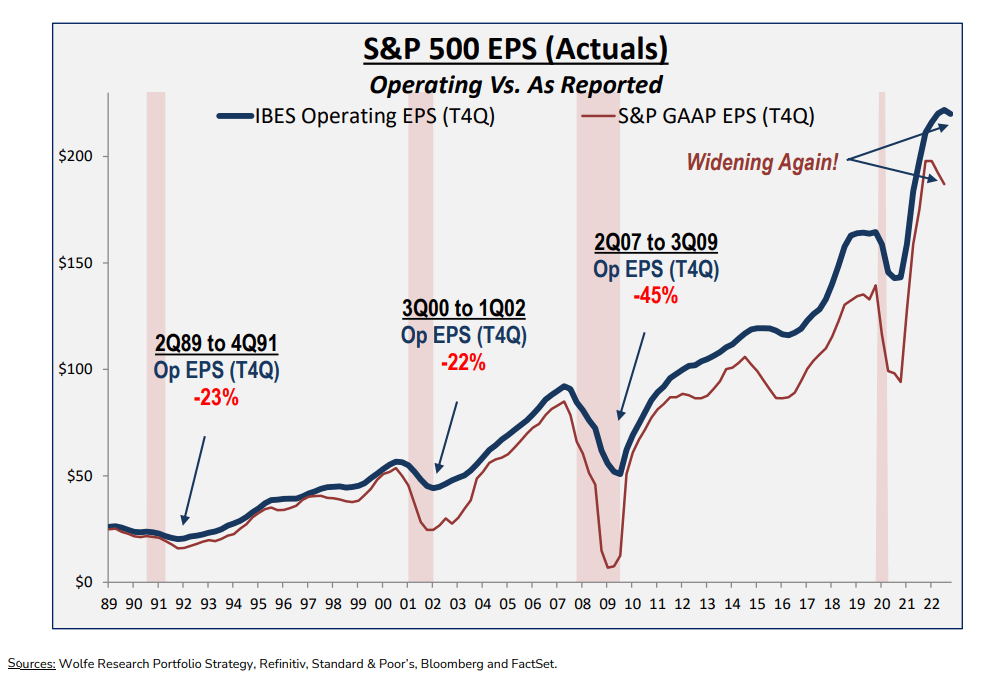

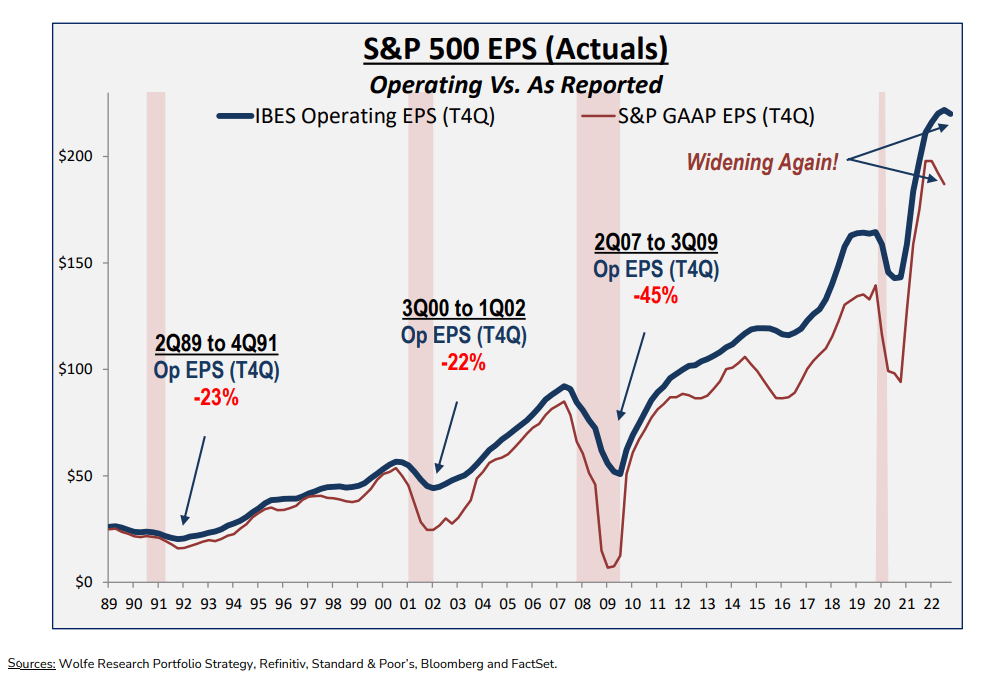

Biden has been whining how evil and selfish and wrong it is for corporations to do stock buybacks. Well, Warren Buffett just politely told Biden he's an idiot.

www.cnbc.com

www.cnbc.com

Warren Buffett calls stock buyback critics 'economic illiterate' in Berkshire Hathaway annual letter

Buffett released his much-anticipated missive on Saturday.

Any chart experts in here? Do commodities act the same as equities as far as technicals go?

Double top there at the end but moving sideways after hours.

Head and shoulders visible on the 5 day and it actually dipped after it but then took off.

Nearly every bit of news suggests going higher, supported by the huge volume increase.

Several producers cutting output.

Colder than normal weather expected through mid March.

Freeport back exporting. Full capacity expected mid March.

Thoughts?

Sent from my iPhone using the svtperformance.com mobile app

Double top there at the end but moving sideways after hours.

Head and shoulders visible on the 5 day and it actually dipped after it but then took off.

Nearly every bit of news suggests going higher, supported by the huge volume increase.

Several producers cutting output.

Colder than normal weather expected through mid March.

Freeport back exporting. Full capacity expected mid March.

Thoughts?

Sent from my iPhone using the svtperformance.com mobile app

I can say for certain I'm not an expert, but I'll chat about it anyway lol.

I don't pay attention to news, it gets me in trouble. I have to focus on just the chart. All my big losses have come from holding stuff based on a pic the media painted. (Of course news of a nuke would be a big deal, but you know what I mean)

I've exited a large portion of this one because of it being overbought on 2hr/4hr...but check out the MACD spreading apart, indicating buying pressure, on the 4hr/1D...that weekly starts to curl and we are gonna be sittin pretty.

That said, this is a longer play than I'm used to, and I've already been bitten once by it.

Sent from my iPhone using Tapatalk

I don't pay attention to news, it gets me in trouble. I have to focus on just the chart. All my big losses have come from holding stuff based on a pic the media painted. (Of course news of a nuke would be a big deal, but you know what I mean)

I've exited a large portion of this one because of it being overbought on 2hr/4hr...but check out the MACD spreading apart, indicating buying pressure, on the 4hr/1D...that weekly starts to curl and we are gonna be sittin pretty.

That said, this is a longer play than I'm used to, and I've already been bitten once by it.

Sent from my iPhone using Tapatalk

I sold half my position today after hrs.

Still holding 8500.

I’m not familiar with Macd or difference in 1hr vs 4hr and the implications.

You think this still has room to run based on technicals then?

Sent from my iPhone using svtperformance.com

Still holding 8500.

I’m not familiar with Macd or difference in 1hr vs 4hr and the implications.

You think this still has room to run based on technicals then?

Sent from my iPhone using svtperformance.com

I think the upside makes it a nice risk vs reward play, but it is running hot. I'd have a trailing stop set for sure so you can't get burned.

To interpret my charts, the 4hr is getting right to the overbought portion where a sell-off is common...but not set in stone. Daily chart says room to run. Weekly needs to have a little more curl for increased confidence.

Please don't roll your dice on my drivel though, with that many shares you are obviously doing something right!

To interpret my charts, the 4hr is getting right to the overbought portion where a sell-off is common...but not set in stone. Daily chart says room to run. Weekly needs to have a little more curl for increased confidence.

Please don't roll your dice on my drivel though, with that many shares you are obviously doing something right!

I think the upside makes it a nice risk vs reward play, but it is running hot. I'd have a trailing stop set for sure so you can't get burned.

To interpret my charts, the 4hr is getting right to the overbought portion where a sell-off is common...but not set in stone. Daily chart says room to run. Weekly needs to have a little more curl for increased confidence.

Please don't roll your dice on my drivel though, with that many shares you are obviously doing something right!

Lol I hear ya. And if I ever take someone’s advice, that’s my call.

I was doing a bit of day trading a couple yrs ago and was doing quite well. My boss, good friend, asked about my positions. Told him I’m looking at XYZ stock. I never bought it. He thought I meant it was a go. Lol. Lost his ass . He just laughed though.

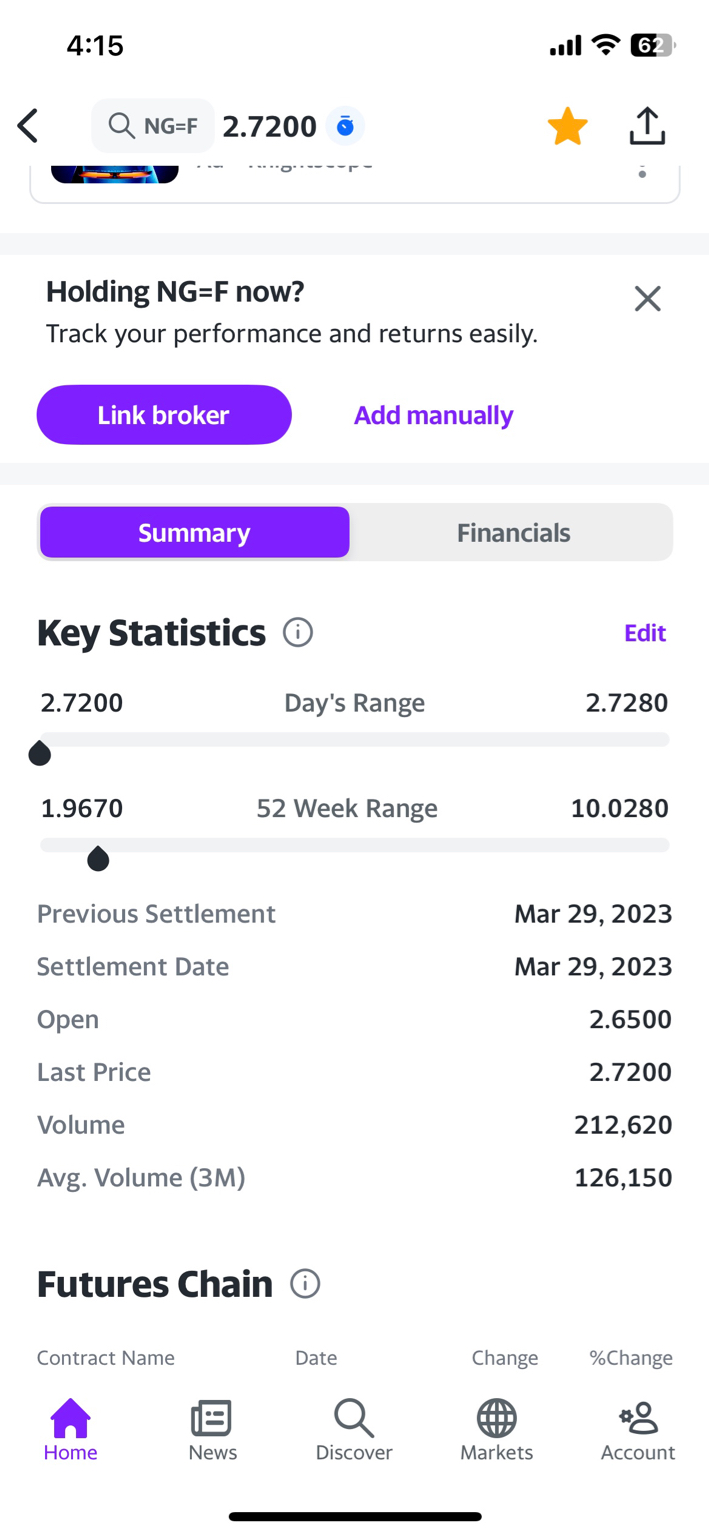

RE the price of gas, I said upper 2s was my target the other day and we’re getting close.

Several items suggest potential for a bit more of an increase but we’re kinda hovering around all time regular prices now. The huge surplus in storage may offset some of the items that would regularly push it higher.

Pumped about this class I’m taking on options in a couple weeks. My understanding of technicals is limited.

Sent from my iPhone using the svtperformance.com mobile app

Another question.

Since this is a leveraged ETF based on the price of something else, do the technicals have as much weight as they would normally?

Or should we be looking at the technicals of the underlying commodity?

Sent from my iPhone using svtperformance.com

Since this is a leveraged ETF based on the price of something else, do the technicals have as much weight as they would normally?

Or should we be looking at the technicals of the underlying commodity?

Sent from my iPhone using svtperformance.com

Landing is looking harder.

That is a good question, because all I've seen used is /NG and that is futures so the chart is not exact...whereas you can bet QQQ/TQQQ will look basically identical. /NG and BOIL are close to this but definitely not perfect.Another question.

Since this is a leveraged ETF based on the price of something else, do the technicals have as much weight as they would normally?

Or should we be looking at the technicals of the underlying commodity?

Sent from my iPhone using svtperformance.com

We are about to find out if this is a dip for BOIL or need to flip back to KOLD.

Good luck in your options class man, I tried them and they're a little too stressful for me lol. With you buying those large amounts of shares you should look into the learntofish guy, it might all be stuff you know already, but he keeps it simple with large buys and get it/get out mentality, compounding. Plus, it's dirt cheap

Cashed my BOIL out for +20%! Only problem is I only had $300 worth, lmao. That's all I had available in the account at the time.

Cashed my BOIL out for +20%! Only problem is I only had $300 worth, lmao. That's all I had available in the account at the time.

20% is 20%.

Good job.

Sent from my iPhone using the svtperformance.com mobile app