Yeah, states have limits on what they can charge. Missouri's is 29.99%.

I can't remember the last time I saw someone actually get that though.

Excellent credit borrowers are still getting 5-6% for 72 months.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Car loans are +10%, What The Heck!??

- Thread starter Corbic

- Start date

Rates suck now without promotional rates, and those are mainly just for new cars through the manufacturers promotions.

But last I saw even 72 month loans were in the 6's. Or at least before the rate hike. So, 48-60 or lower could be high 5?

But last I saw even 72 month loans were in the 6's. Or at least before the rate hike. So, 48-60 or lower could be high 5?

No. He was doing his job making money for the company.

Yeah, maybe...but ignorantly. Why state something that's not remotely close? At the quoted rates, 99% of customers will get their own financing.

Rates suck now without promotional rates, and those are mainly just for new cars through the manufacturers promotions.

But last I saw even 72 month loans were in the 6's. Or at least before the rate hike. So, 48-60 or lower could be high 5?

5-6% rates really aren't all that bad. 2% money is part of the reason our country is where it is. It was too easy, and too cheap to borrow money.

I got 2.75% on my Rebel last year, new purchase. Maybe shop new and get a better rate.

Yeah, maybe...but ignorantly. Why state something that's not remotely close? At the quoted rates, 99% of customers will get their own financing.

View attachment 1806422

5-6% rates really aren't all that bad. 2% money is part of the reason our country is where it is. It was too easy, and too cheap to borrow money.

Nah, no real complaint, but it still sucks to have one vehicle at 1.9% and then one at 6.4%. Payments are fine, just the interest difference lol.

At first the dealer told me the loan was going to be 8.4%. Said thanks for the offer but I'm good. Then 1 minute later it was 7.4%. Refinanced shortly after to 6.4

Nah, no real complaint, but it still sucks to have one vehicle at 1.9% and then one at 6.4%. Payments are fine, just the interest difference lol.

At first the dealer told me the loan was going to be 8.4%. Said thanks for the offer but I'm good. Then 1 minute later it was 7.4%. Refinanced shortly after to 6.4

The dealer was trying to make the 1% off of the loan. Doesn't equate to much, but if you do that on every deal, you make some money.

This, if you already go with the lowest rate, they will try to match it right off the bat.The dealer was trying to make the 1% off of the loan. Doesn't equate to much, but if you do that on every deal, you make some money.

Happened to me, they pre-qualified me to the "avg" at 8-9%, told them what a credit union gave me, walked out at 6% lol

Wait till the market crashes like in 2007 and they’ll be offering 0% for 60 months just to move metal.

This, if you already go with the lowest rate, they will try to match it right off the bat.

Happened to me, they pre-qualified me to the "avg" at 8-9%, told them what a credit union gave me, walked out at 6% lol

Not always the case...but definitely possible.

Wait till the market crashes like in 2007 and they’ll be offering 0% for 60 months just to move metal.

Fortunately/unfortunately, the auto industry is going to be insulated as far as a strong downturn. There was over a full years worth of production lost, and manufacturers are still operating at less than 100% today. The lack of available inventory is going to keep the auto industry moving.

Anyone with credit bad enough to accept a rate of 29% likely has no intent of making timely payments.Yeah, states have limits on what they can charge. Missouri's is 29.99%.

I can't remember the last time I saw someone actually get that though.

Excellent credit borrowers are still getting 5-6% for 72 months.

I bought my new Explorer in 2014 and that's the financing I received. I think it'll be some time before that becomes common again but who knows? China's economy seems it might be going into free fall.Wait till the market crashes like in 2007 and they’ll be offering 0% for 60 months just to move metal.

Everyone just got used to low interest rates. Used to be 6-8% was normal for mortgages, car loans were higher. Money costs more now and those that want the big house with all the toys and have to finance it are hurting and they don’t like it. My last mortgage I think the most I paid like 2.3 % on a variable rate. Now it would be well over 7%, it’s money supply and demand as well as hard goods supply and demand, cars cost more because manufacturers are not up to full speed yet. I suspect that manufacturers are holding back because of issues with the work force along with supply chain problems

One thing I've read about the mortgages.

When rates go down, prices will go up again. So it's all moot. The .gov ****ed us all. They should have left rates at 4% and dried up the money supply by backing off all the handouts. The Fed thought housing prices would come down with rate increases but they didn't. To many investment cash buyers and to many people not willing to give up their existing mortgages.

Hey now, Biden said we were going to spend our way out of inflation. And then he said it was just transitory. I don't believe my president would ever lie to me so I feel like they were just wrong on this small matter instead of outright gaslighting us on Covid and inflation.

In seriousness, what in the actual ****, who are the morons who believed any of the shit these assholes were peddling.

And I agree, the government should have used whatever means necessary to keep mortgage rates below 5% and DEFINITELY below 6%.

Last edited:

That is just the OEM buying down the rate to be competitive against banks. Not really a normal rate.Genesis is advertising 3.49% for 60 months for a new car.

A local credit union is advertising 5.39% for a used car (2022-2024) for 36 months.

Fake news!

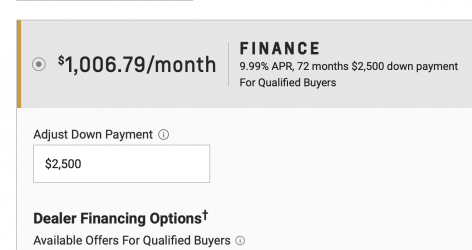

Local dealer is only 9.99% not 10!

That is just what the dealer has their website set at to figure payments. Has very little to do with actual rates.

In 1974, that’s like 50 years ago, average mortgage rates were 9.19%. If you want to talk about high interest rates we can look at the early’80’s.Hey now, Biden said we were going to spend our way out of inflation. And then he said it was just transitory. I don't believe my president would ever lie to me so I feel like they were just wrong on this small matter instead of outright gaslighting us on Covid and inflation.

In seriousness, what in the actual ****, who are the morons who believed any of the shit these assholes were peddling.

And I agree, the government should have used whatever means necessary to keep mortgage rates below 5% and DEFINITELY below 6%.

In 1974, that’s like 50 years ago, average mortgage rates were 9.19%. If you want to talk about high interest rates we can look at the early’80’s.

Upper teens for sure. It just wasn't that big of a deal since the average house price was less than $70k...today it's $238k.

And a brand new car was 5k, average wage was $11,100. It’s all relative.Upper teens for sure. It just wasn't that big of a deal since the average house price was less than $70k...today it's $238k.

And a brand new car was 5k, average wage was $11,100. It’s all relative.

110%

You're right.

Not always the case...but definitely possible.

Fortunately/unfortunately, the auto industry is going to be insulated as far as a strong downturn. There was over a full years worth of production lost, and manufacturers are still operating at less than 100% today. The lack of available inventory is going to keep the auto industry moving.

And the EV production affecting ICE production.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)