You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is it time to worry about the stock market?

- Thread starter black4vcobra

- Start date

Pretty crazy market.

So clue me in. What the flip happened today?

I think some of it was from consumer spending from Amazon.So clue me in. What the flip happened today?

Yes i do. Let me guess contact them and they can help me

My $0.02 on the stock market.

1.) 85% of all stocks are automated trading options.

The nice thing about this is, you as an individual, can set up plenty of buy/sell rules within your portfolio to hopefully save you if the market starts tanking, etc. OR buy more stock if the stock starts increasing at a specified rate over a specified period of time. The problem with that is, say the stock drops 5% in 4 hours...well someone, multiple someones, will have a rule set up to sell (to protect themselves). If enough stock is sold fast enough, then the stock may decreased another 1-3%, which MAY ignite someone else's buy/sell, causing a faster sell off of stock, and further plunging the stock. (Same thing, just opposite if the market is increasing dramatically).

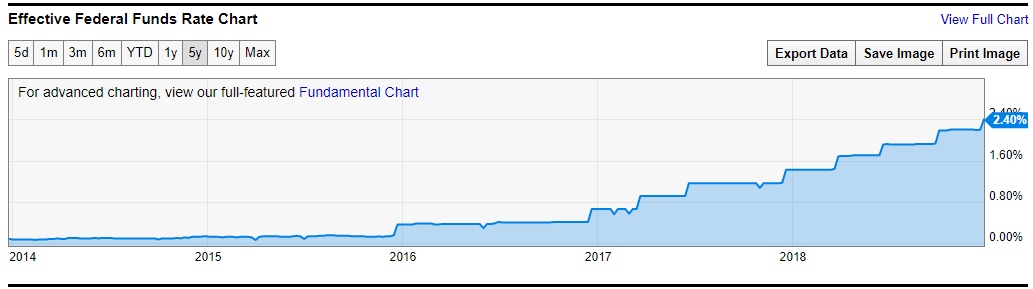

2.) The Federal Reserve raising the interest rate doesn't help, and clouds the waters when you talk about the economy's future.

On January 2nd of this year, the Federal Reserve had the interest rate set at 1.4%, it is now 2.4%. That 1% increase effects all kinds of borrowing, which affects all kinds of building and other opportunities of growth in our country. It hurts consumers ability to purchase homes, automobiles, small business loans, etc; which all create a lull in the economy and lowers people's perception of the future of the economy.

Interest rates have been at all time lows for years, which IS NOT GOOD for long term growth. However, increasing the interest rate 6.5 times over a 2 year period isn't healthy for the economy either. Trump is doing a great job in office, the economy is thriving, and then the fed reserve goes and increases the interest rate.

1.) 85% of all stocks are automated trading options.

The nice thing about this is, you as an individual, can set up plenty of buy/sell rules within your portfolio to hopefully save you if the market starts tanking, etc. OR buy more stock if the stock starts increasing at a specified rate over a specified period of time. The problem with that is, say the stock drops 5% in 4 hours...well someone, multiple someones, will have a rule set up to sell (to protect themselves). If enough stock is sold fast enough, then the stock may decreased another 1-3%, which MAY ignite someone else's buy/sell, causing a faster sell off of stock, and further plunging the stock. (Same thing, just opposite if the market is increasing dramatically).

2.) The Federal Reserve raising the interest rate doesn't help, and clouds the waters when you talk about the economy's future.

On January 2nd of this year, the Federal Reserve had the interest rate set at 1.4%, it is now 2.4%. That 1% increase effects all kinds of borrowing, which affects all kinds of building and other opportunities of growth in our country. It hurts consumers ability to purchase homes, automobiles, small business loans, etc; which all create a lull in the economy and lowers people's perception of the future of the economy.

Interest rates have been at all time lows for years, which IS NOT GOOD for long term growth. However, increasing the interest rate 6.5 times over a 2 year period isn't healthy for the economy either. Trump is doing a great job in office, the economy is thriving, and then the fed reserve goes and increases the interest rate.

It absolutely isn't a joke. I have a friend that just bought a house and when he told me how much I asked if he could afford it. He quickly answered no but that it's cheaper than renting and he needs a place. I'm looking for a place now as well and am seeing the same thing. Time to sacrifice my living situation to continue to get ready for it.Here in Socal, rent is more than a mortgage EVERYWHERE. If you own, you are LUCKY because your mortgage is significantly lower. Not a joke, btw.

It absolutely isn't a joke. I have a friend that just bought a house and when he told me how much I asked if he could afford it. He quickly answered no but that it's cheaper than renting and he needs a place. I'm looking for a place now as well and am seeing the same thing. Time to sacrifice my living situation to continue to get ready for it.

I have such a hard time seeing why people want to subject themselves to that kind of living expense.

I was out in NYC three weeks ago and just happened to look at some condos and stuff for sale in Manhatten. Let's do some comparison of what my house's value would get me there compare to what I have in Kansas City.

NYC: 500-800 square feet. 2 bedroom, 1.5 bath. 4 windows. Upgraded kitchen, master bath, new flooring. 1 Parking spot. $5k a year in taxes.

KC: 7000 square feet. 5 bedroom, 4.5 bath, 1 office. Upgraded kitchen, master bath, new flooring. 3 car garage. 3 acres. In ground pool. Built in sauna. 30 foot tall ceilings in entry way and living room. 1,300 square foot master bedroom/bathroom. 65 square foot shower. $10k a year in taxes.

I would literally have to multiply my income by 5 in order to continue my life style living in NYC.

The MSM has been gloom and doom predicting a collapse or the market and the economy because of their hatred of Trump. So what happened? The underlying economic numbers are strong, the job market is healthy, unemployment is low and retailers had one of their best holiday seasons in many years. People are also realizing the government shutdown is a big nothing in the real world with zero consequences to the average Joe. Many saw a good buying opportunity today and we got the highest daily point total in history, The DOW gained back 2/3rd of its losses from last week.So clue me in. What the flip happened today?

The MSM has been gloom and doom predicting a collapse or the market and the economy because of their hatred of Trump. So what happened? The underlying economic numbers are strong, the job market is healthy, unemployment is low and retailers had one of their best holiday seasons in many years. People are also realizing the government shutdown is a big nothing in the real world with zero consequences to the average Joe. Many saw a good buying opportunity today and we got the highest daily point total in history, The DOW gained back 2/3rd of its losses from last week.

People planning for retirement are scared shitless. If volatility continues to the down side people will be exiting and the power players will be shorting every rally. Cheap options to the way down side will be in the money by summer.

Sent from my iPhone using the svtperformance.com mobile app

I have such a hard time seeing why people want to subject themselves to that kind of living expense.

I was out in NYC three weeks ago and just happened to look at some condos and stuff for sale in Manhatten. Let's do some comparison of what my house's value would get me there compare to what I have in Kansas City.

NYC: 500-800 square feet. 2 bedroom, 1.5 bath. 4 windows. Upgraded kitchen, master bath, new flooring. 1 Parking spot. $5k a year in taxes.

KC: 7000 square feet. 5 bedroom, 4.5 bath, 1 office. Upgraded kitchen, master bath, new flooring. 3 car garage. 3 acres. In ground pool. Built in sauna. 30 foot tall ceilings in entry way and living room. 1,300 square foot master bedroom/bathroom. 65 square foot shower. $10k a year in taxes.

I would literally have to multiply my income by 5 in order to continue my life style living in NYC.

Location, location, location. Some like the ability to walk out onto a street and have almost whatever they could want in a 4-5 block radius. As I get older that concept has actual appealed to me. I also like the idea of moving out into the middle of nowhere. LOL.

Location, location, location. Some like the ability to walk out onto a street and have almost whatever they could want in a 4-5 block radius. As I get older that concept has actual appealed to me. I also like the idea of moving out into the middle of nowhere. LOL.

**** location lol I would never, ever do that.

Good day yesterday and today!DOW up almost 1100 points.

I made $5k yesterday, lost like 15 in the last two weeks though. lolGood day yesterday and today!

DAMN!!! I didn't lose that much, but I lost.I made $5k yesterday, lost like 15 in the last two weeks though. lol

It'll come back. Up over 23,000 points as of today.

Agreed.I don't think someone has to know a lot about the stock market to recognize ever increasing amounts of student loan debt, credit card debt, auto loan debt, mortgages they can't afford, etc. Combine that with people being behind on retirement savings and a federal government that is beyond broke and there are a lot of bad signals out there.

Go look at your average, middle class family and they are probably up to their eyeballs in debt and couldn't quickly come up with $500 to pay to get an alternator replaced on their car.

Tons of my peers are in debt.

Sent from my SM-G892A using the svtperformance.com mobile app

Didnt read all this, but im sure you have some valid points.I don't need to know anything about stocks to apply statistical reasoning.

The median home price is out of the traditional metrics for affordability compared to income. Home prices have outpaced inflation by 35%. Gas has outpaced inflation by 75%. The essential costs of living are FAR outpacing inflation and FAR outpacing the average wage increase. Average education debt has soared, auto loan debt has soared, credit card debt has soared. In fact, every single essential cost of living is outpacing inflation by a staggering amount. Non-essential costs of living are also outpacing inflation by staggering amounts. On top of that people are waiting longer to get into homes and taking longer home loans once they do. Statistically people are saving less for retirement and household debt has soared to all time highs.

Explain to me how all of this is good? I realize everyone is convinced that everything will keep going up but reality is that it doesn't. In 2007 everyone was telling me I was an idiot for saving my money and not buying a house because investing in the housing market was a sure thing that would never end. Bitcoin? Same thing, it's going to soar past 100k....I was an idiot for not buying into it at 19k. Seriously, how have people not learned their lessons yet? There is a correction of some sort coming, it has to. The cost of living cannot keep blowing income out of the water and not have long term consequences. So there you have it, while I don't know anything about the stock market I can read statistics and I can spot the same bullshit arguments that are made during every bubble. It's not hard, history has a tendency to repeat itself.

Sent from my SM-G892A using the svtperformance.com mobile app

No, hit me up on pm. I can walk you through it.Yes i do. Let me guess contact them and they can help me

Sent from my SM-G892A using the svtperformance.com mobile app

Here in Socal, rent is more than a mortgage EVERYWHERE. If you own, you are LUCKY because your mortgage is significantly lower. Not a joke, btw.

No its not.

You cannot find a house to buy in socal, especially SD, for under half a mil. That's a $3500 mortgage with tax/ins/etc. And its a ****ing shanty you'll be buying at that price.

I rent for $1k for a 650sf 1br. I can get a 2br luxury apt down the street for $2000 if/when we decide to upgrade. Still not a mortgage. You have to rent at some high end places to equal the cost of a mortgage payment.

Maybe if you were lucky enough to buy in the 80's/90's or 2008-2010 you are looking good mortgage wise. Everyone else, its like standing at the base of Everest and looking at the peak going "Who's climbing that? **** that"

Users who are viewing this thread

Total: 6 (members: 0, guests: 6)