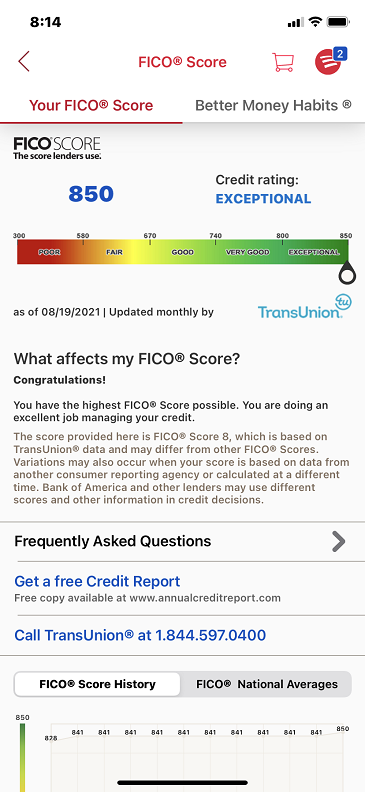

It's been a long road and I never thought it was possible but I finally got a perfect credit score. It's with TransUnion, my Equifax is at 843. I use five credit cards, keep the post balance below $50 and pay it to $O, after it posts. I know it won't stay there but nice to see after all these years.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FICO Credit Scores

- Thread starter Skitzerman

- Start date

Nice. The only person I know who has one is my aunt. She puts literally everything on one card every month and makes that one payment.

What I don't understand is one month it's 850 and the next it's 847?

For me mine hovers around 795-800.

What I don't understand is one month it's 850 and the next it's 847?

For me mine hovers around 795-800.

I think I’ve only touched 800 one time..... I’ve never known anyone to have an 850 - Bravo Sir.

I thought a "Perfect" credit score was just a myth.

Didn’t realize it could actually be done lol

As long as mine stays over 800 I don’t care too much

As long as mine stays over 800 I don’t care too much

I always thought the 850 was an unreachable carrot, also like the disclaimer my bank posts.

.

The score provided here is FICO® Score 8, which is based on TransUnion® data and may differ from other FICO® Scores. Variations may also occur when your score is based on data from another consumer reporting agency or calculated at a different time. Bank of America and other lenders may use different scores and other information in credit decisions.

.

The score provided here is FICO® Score 8, which is based on TransUnion® data and may differ from other FICO® Scores. Variations may also occur when your score is based on data from another consumer reporting agency or calculated at a different time. Bank of America and other lenders may use different scores and other information in credit decisions.

So did I and I'm sure it'll change next month because the wind shifted direction. lolI thought a "Perfect" credit score was just a myth.

Mine is in the 830’s. At 37 years old not to shabby it’s something I take pride in for sure. I like when I go to buy a vehicle and the dealers say let’s see if you can get approved and I’m like buddy that angle isn’t gonna work with me lol.

From the time my score went over 750 or so I never had a problem qualifying for anything at the lowest offered rate. Which is why I have no desire to play the game and get closer to 850.Mine is in the 830’s. At 37 years old not to shabby it’s something I take pride in for sure. I like when I go to buy a vehicle and the dealers say let’s see if you can get approved and I’m like buddy that angle isn’t gonna work with me lol.

I don’t have a mortgage that’s in their books, don’t have a car payment or other installment loan. Adding another card or two would bring my utilization down that’s about the only thing I kightndo

But, that's part of the trick credit repair companies do. All 3 reports are supposed to be within X of each other. If one is significantly lower, take the higher two to the third and the third will come up. Just one of the many games they playtough feat to concur.

I know that every credit lender uses different credit reporting agency so sometimes your report could be all over the place depending on what was used to get your info.

"Nothing makes me question ALL of my life decisions like SVTP."

Posts and likes are not mine.

I'm sitting pretty good with about a 825

If you have a good credit score, there's no reason to even consider using a dealer to finance a car... use your bank or a credit union, especially if buying used. Dealer finance departments are about as shady as they come to begin with, especially with trying to rip you off adding warranty crap or protection plans.Mine is in the 830’s. At 37 years old not to shabby it’s something I take pride in for sure. I like when I go to buy a vehicle and the dealers say let’s see if you can get approved and I’m like buddy that angle isn’t gonna work with me lol.

My FICO is 850

My Transunion is 831

My Equifax is 836

Depends on the reporting agency and when they last looked at your CC balances, home loan balance, automotive balance, etc.

FICO seems to be the easiest to get and keep at 850. Never seen my Transunion or Equifax go higher than 836.

Strange.

U.M.

My Transunion is 831

My Equifax is 836

Depends on the reporting agency and when they last looked at your CC balances, home loan balance, automotive balance, etc.

FICO seems to be the easiest to get and keep at 850. Never seen my Transunion or Equifax go higher than 836.

Strange.

U.M.

My Transunion is always a good 20 pts lower than Equifax

I have an 813 but I paid off my car and the $1300 I had on one card so I wonder what my score will be in a month or two. 825?

when I first paid off my truck my score crashed pretty hard, 2-3 months later was back to where it was. To me that just proves it's largely a bullshit

Sweet.

Just to clarifiy, an 800+ score is mandatory for SVTP members.

My current debt load is $ 80.87, & only because the bill hasn't showed up yet.

My monthly expenses are food & utilities, & I still manage a 825+ credit score..

My monthly expenses are food & utilities, & I still manage a 825+ credit score..

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)